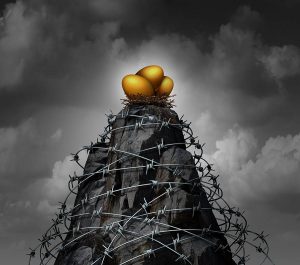

We all take risks every day. Some of those risks can be avoided and some can be transferred through use of insurance. Proper planning can also minimize liability by the creation of legal entities recognized by the law to provide protection from lawsuits, creditors, etc. You spend your entire lifetime building up your assets. It is important to at least know what options you have when it comes to asset protection. If you are in a profession where lawsuits can happen, this is especially key.

We all take risks every day. Some of those risks can be avoided and some can be transferred through use of insurance. Proper planning can also minimize liability by the creation of legal entities recognized by the law to provide protection from lawsuits, creditors, etc. You spend your entire lifetime building up your assets. It is important to at least know what options you have when it comes to asset protection. If you are in a profession where lawsuits can happen, this is especially key.

Business owners can minimize personal liability by incorporating or setting up an LLC. Selecting the appropriate legal entity is critical for managing your risk. Sometimes special types of irrevocable trusts may be appropriate to protect assets like real estate, brokerage accounts or other funds. It may also become necessary to protect your assets from nursing home costs. Proper planning can be advantageous to preserve assets.